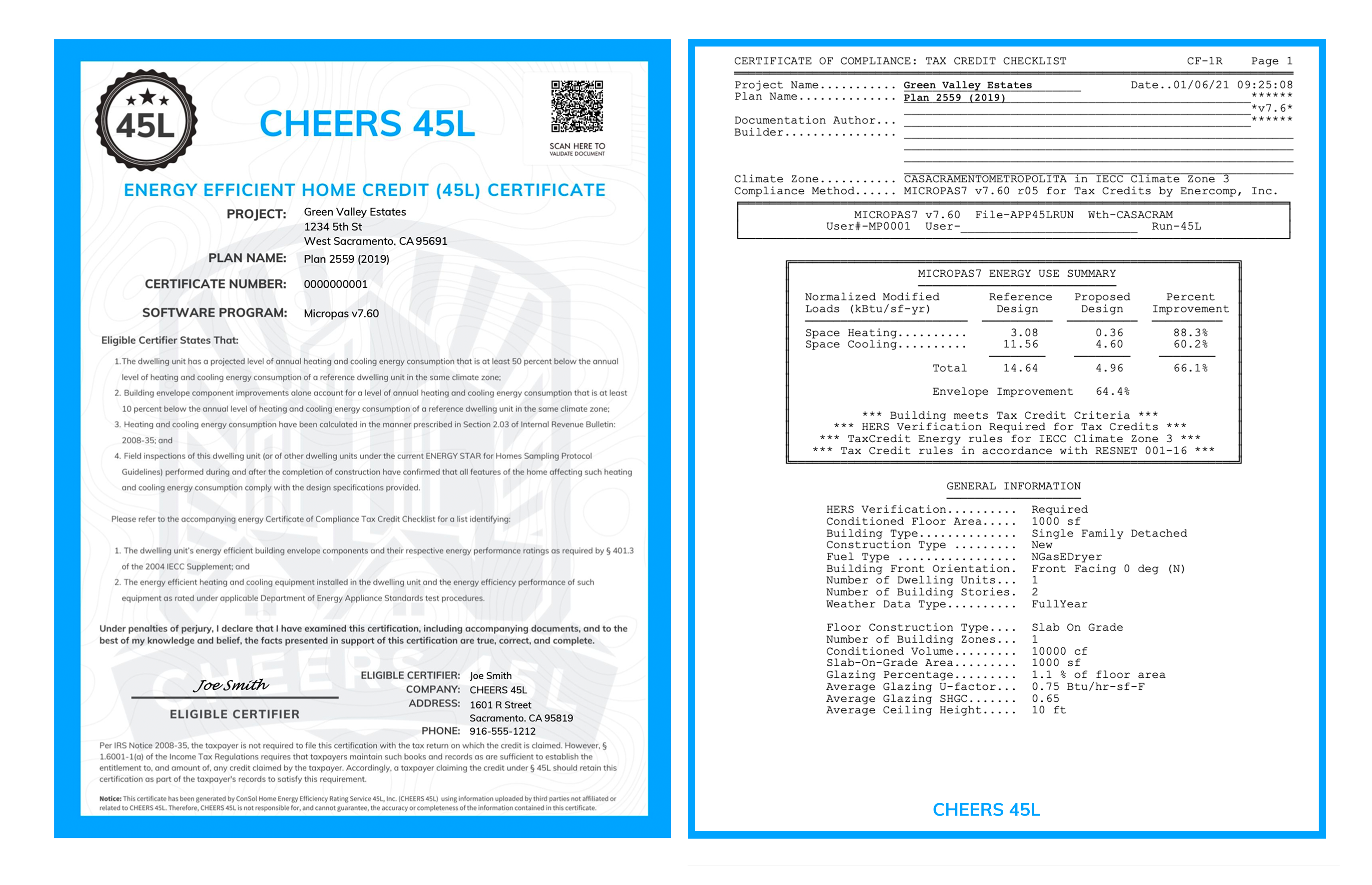

45l tax credit form

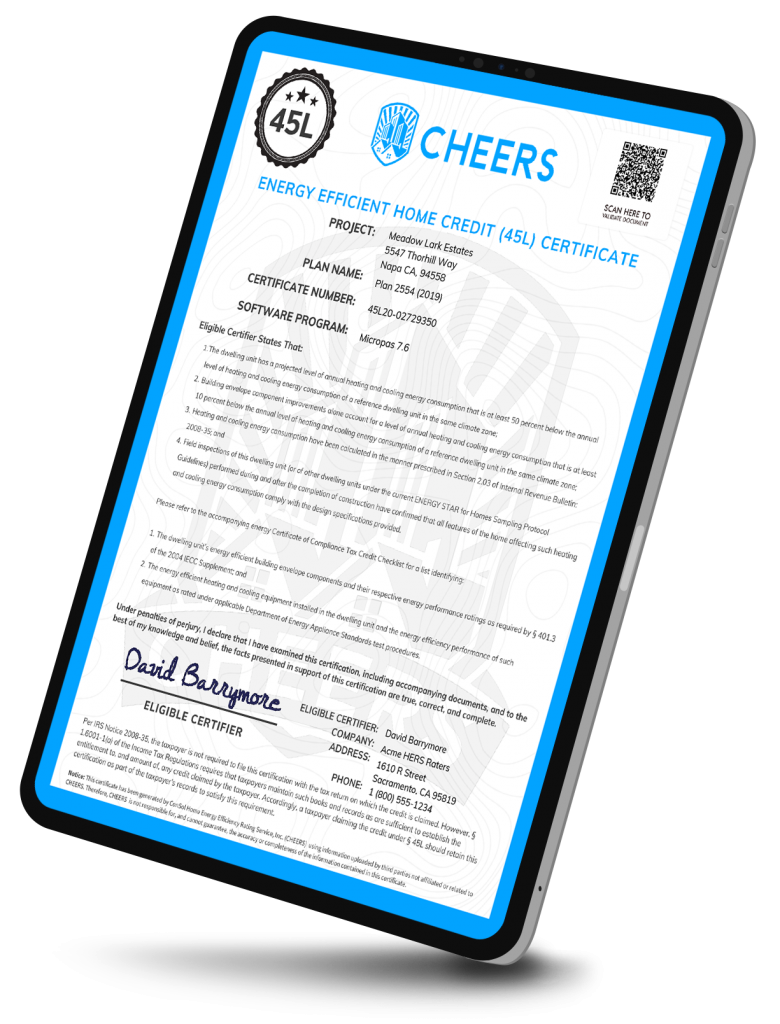

THE 45L ENERGY EFFICIENT HOME CREDIT. IRS Form 8908 is used to claim the 45L tax credit.

7 Income Tax Saving Tips You Might Not Know Income Tax Saving Income Tax Tax Services

The 45L tax credit allows taxpayers to claim potentially significant credits for the construction of new energy-efficient homes.

. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed. Enter total energy efficient home credits from. For qualified new energy efficient homes other than manufactured homes the amount of the credit is 2000.

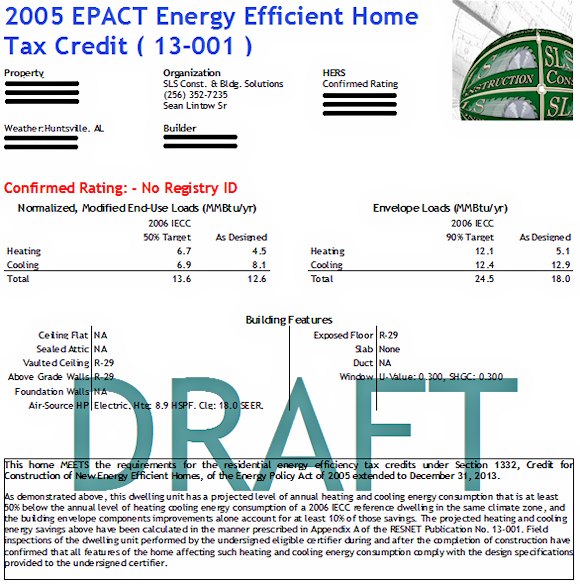

1865 Further Consolidated Appropriations Act at the end of 2019. In order to claim the credit a licensed third-party through must conduct on-site testing and energy modeling to produce a certification package with a declaration that the dwelling unit is 50 more energy efficient than a. Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings.

How do you know if your property qualifies. Read on for eligibility requirements and then submit a 45L. The 45L Tax Credit allows owners and developers of single and multi-unit residential properties including assisted living facilities to claim credits for newly constructed or renovated properties.

Find out if you have qualified for this unique tax credit by contacting Metro Code today. The program was also made retroactive meaning homes built. The 45L was established to help and encourage builders manufacturers and developers to construct more energy efficient buildings.

If you are a developer that has built a low-rise multifamily property the 45L tax credit could benefit your company. Qualifying properties include apartments condominiums townhouses and single family homes. Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home.

The term 45L comes from the federal statute called US Code 26 Subsection 45L. The 45L Tax Credit is available for Builders who have financed the construction of energy efficient homes and then leased or sold them. A dwelling unit qualifies for the credit if--.

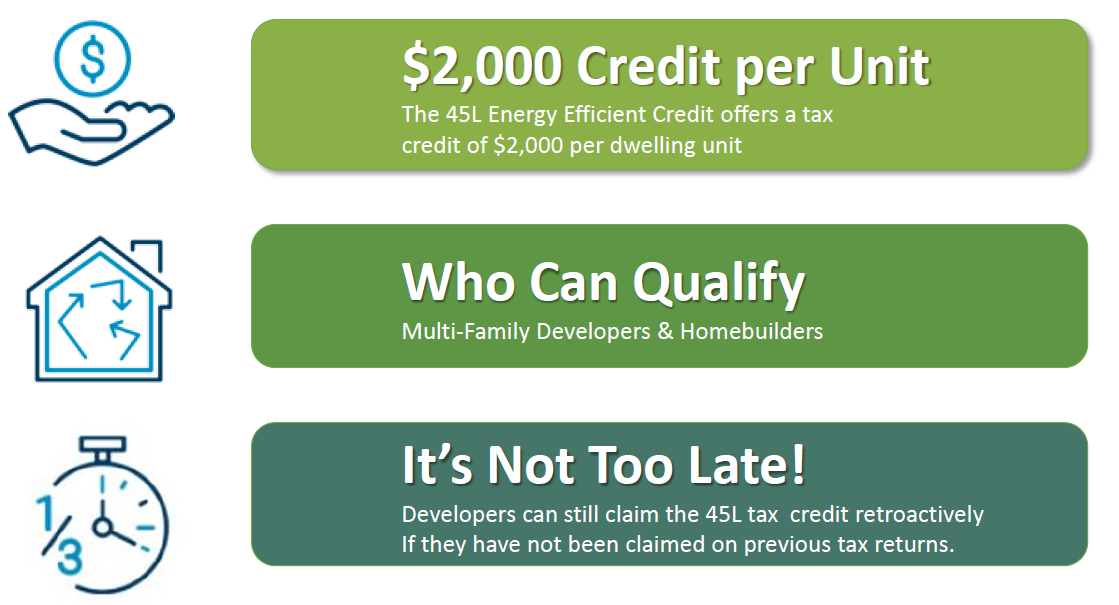

The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by an eligible contractor and acquired by a person from the eligible contractor for use as a residence during the tax year. Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold during the year. Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each energy efficient dwelling unit is retroactively available for projects placed in service from 2018 to 2020 and through the end of 2021.

It applies to single family homes apartments condominiums assisted living homes student housing and other types of residences. Claiming Energy efficient 45L tax credit using 8908 form for a new fourplex construciton. The qualified contractor typically the developer builder or homeowner is the only person who can claim the 45L tax credit and must own the unit at the time of construction or improvement.

Real estate developers can claim 2000 per dwelling or residential unit on. Once the certifier has provided you with all the certifications you need you will have to use IRS Form 8908 Energy Efficient Home Credit to file for the 45L tax credit. 45L Energy Efficient Dwelling Unit Tax Credits If you develop build or own energy efficient residential dwelling units you could earn tax credits of 2000 per unit.

The credit can be taken on amended returns or carried forward up to 20. As part of the New Energy Efficient Home Tax Credit under Code Section 45L a 1000 credit is also available for an eligible contractor with respect to a manufactured home. The tax credit was retroactively extended from December 31 2017 to December 31 2020 by HR.

Asset Environments can assess and qualify projects nationwide and are only compensated if your property meets the certification. Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit. 45L Federal Tax Credit 45L tax form 8908.

The 45L credit is claimed on IRS Form 8908. And you could receive a 2000 per unit tax credit. The credit is typically not available a person eventually residing in the home.

Certified properties quality for a 2000 tax credit per unit. What is the 45L Tax Credit. The credit is typically not available a person eventually residing in the home.

Submit the contact form at the bottom of the page or call 804-225-9843 to find out how to take advantage of the 45L Tax Credit. To qualify for the 2000 tax credit eligible dwelling units must be certified to meet or exceed the required energy efficiency benchmarks and then sold or leased no later than December 31 2021. The 45L tax credit was intended to help buildersproperty owners claim around 2000 in tax credit for each energy-efficient home they construct or sell.

The 45L Energy-Efficient Home Tax Credit is equal to 2000 per residential unit or dwelling to the developers of energy-efficient buildings. The 45L Tax Credit originally made effective on 112006 offers 2000 per dwelling unit to developments with energy consumption levels significantly less than certain national energy standards. This incentive was a program enacted back in 2006 and signed with updates as of.

A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed. Congress extended the section 45L Tax Credit in December 2019 to encourage the construction industry to build and sell more high-performance homes. The actual form to fill out with taxes is not even half a page and not that intimidating.

You will need to complete the form yourself and add it to the return using the FORMS mode in one of the TT DownloadedCD versions and then attach it to the paper return you will need to mail. The 45L program is the best kept secret among developers and builders. The 45L tax credit for energy-efficient homes provides 2000 per unit for owner-occupied or rental dwelling buildings that meet certain qualifications.

IRS Form 8908 is used to claim the 45L tax credit. These valuable credits are overlooked due to a lack of understanding about the qualification process. We can help save you money on each qualified home.

However these valuable credits are often overlooked simply because those who. Report Inappropriate Content. Schedule K-1 Form 1065 Partners Share of.

Currently the 45L Credit allows eligible developers to claim a 2000 tax credit for each newly constructed or substantially reconstructed qualifying residence. The manufactured home must have a projected level of annual heating and cooling energy consumption that is at least 30 below the annual level of heating and cooling energy.

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

The Home Builders Energy Efficient Tax Credit An Faq

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

This Represents Ambiguous Because It S Unclear On Which Way You Can Go Vocab Ambiguity Tech Company Logos

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And H Paparazzi Jewelry Images Paparazzi Jewelry Paparazzi Jewelry Displays

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Green Building That Saves You Big Bucks With 45l Tax Credit Benefits Income Tax Tax Preparation Tax Deductions

The 45l Tax Credit Is Expiring Again Cheers 45l

What Did We Learn From The Paradise Papers Paper Learning Paradise

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And Help Paparazzi Consultant Paparazzi Fashion Paparazzi Jewelry Displays

45l Tax Credit Services Using Doe Approved Software

This Represents Inadvertent Because The Waiter Is Too Busy Looking At The Woman That He Accidentally Spills The Food On The Man Vocab Chapter Chapter 3

How Does The 45l Tax Credit Work Energy Diagnostic

How To Pay Off A Tax Debt Capital Gains Tax Tax Debt Tax Accountant